Digital advertising is now a necessary component of any modern company, including financial services providers. With the introduction of online advertising platforms such as Google Ads, financial services providers can more easily contact their target audience and improve their conversion rates.

We will provide a thorough guide on how financial services providers can use Google Ads to grow their businesses in this blog post.

Our primary emphasis will be on developing effective Google Ads campaigns that are tailored to the specific needs of the financial services sector.

Table of Content

Understanding the Basics of Google Ads

Google Ads is a powerful advertising platform that enables businesses to display ads on Google’s search engine results pages (SERPs) as well as other websites in the Google Display Network.

There are three types of ads available on Google Ads:

Search Ads: These are text-based advertisements that show at the top of search engine results on pages when a user searches for a specific keyword.

If someone looks for “best credit cards,” they will see credit card advertisements at the top of the page.

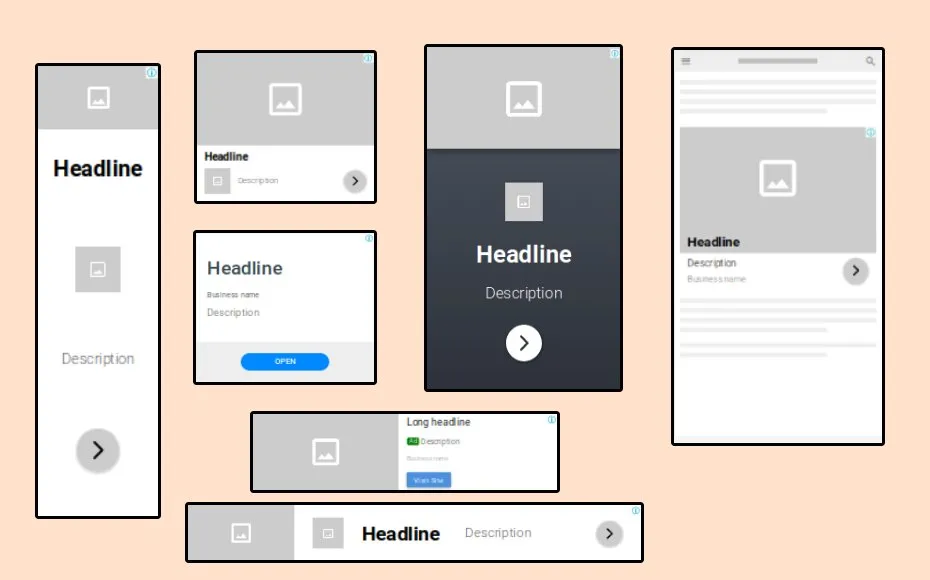

Display Ads: These are visual advertisements that show on other websites in the Google Display Network. Images, videos, and interactive components can all be used in display ads.

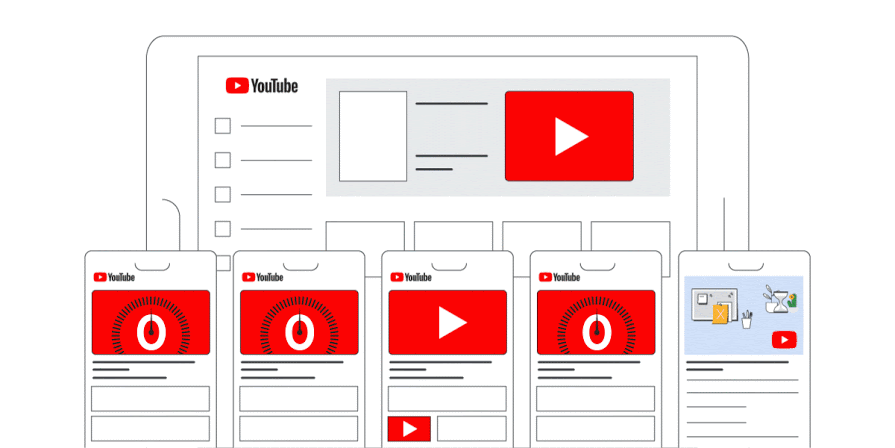

Video Ads: Ads that show before, during, or after a video on YouTube or other websites is known as video ads.

Google Ads works on an auction system, with advertisers bidding on keywords relevant to their business. The highest bidder for a specific keyword receives the top position on the SERP or the website where the ad appears.

How to Use Google Ads to Generate Leads for Your Service

Define your target audience: Before you start a Google Ads campaign, you should define your target audience. This will assist you in creating advertisements that are tailored to their wants and interests.

For example, if you’re promoting a credit card, your target audience could be people with excellent credit who want to receive rewards.

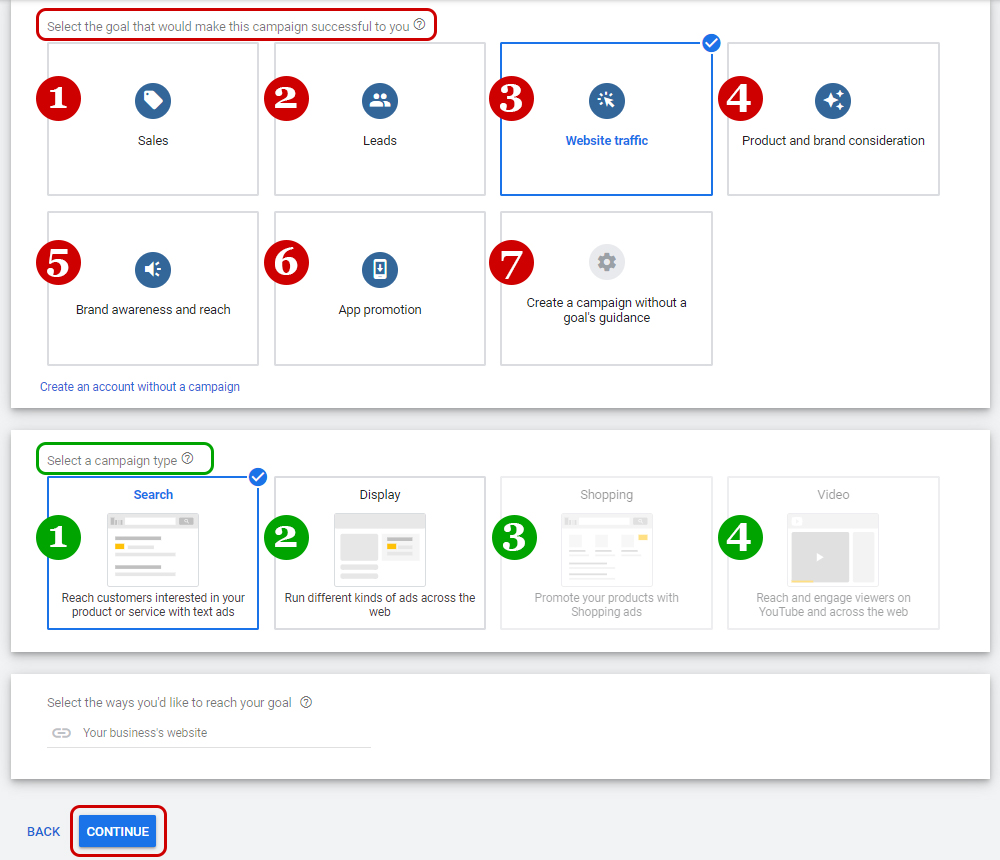

Set your goals: make clear goals for your Google Ads campaign: It is critical to make clear goals for your Google Ads campaign. This will allow you to assess the success of your campaign and make changes as required.

For example, you might want to increase the amount of credit card applications by 10% in the coming quarter.

Create a budget: Make a budget: Setting a budget for your Google Ads plan is critical to avoiding overspending. Depending on your needs and objectives, you can create a daily or monthly budget.

Choose the correct keywords: Keyword selection is critical to the success of your Google Ads campaign. Choose keywords that are pertinent to your company and have a high search volume.

If you’re advertising a savings account, for example, your keywords could include “best savings account,” “high-yield savings account,” and “online savings account.”

Choose the right keywords: Keyword selection is critical to the success of your Google Ads campaign. Choose keywords that are pertinent to your company and have a high search volume.

For example, if you are promoting a savings account, your keywords may include “best savings account,” “high-yield savings account,” and “online savings account.”

Craft compelling ad copy: Ad copy is the text that shows in your advertisement. It is critical to creating appealing ad copy that will attract people to engage with your ad. To motivate people to take action, highlight the benefits of your product or service and use a call-to-action.

For example, if you are promoting a personal loan, your ad copy may include “Get approved for a personal loan in minutes” and “Low rates and flexible terms.”

Create effective landing pages: When individuals click on your ad, they are directed to a landing page. It is essential to develop an effective landing page that is relevant to your advertisement and has a clear call to action. The landing website should also be conversion-optimized, with a clear and simple application form.

Advanced Google Ads for Financial Services

Google Ads has several advanced features that financial services providers can use to improve the efficacy of their advertisements. Here are some advanced elements to think about:

Dynamic search ads:These are ads that are produced automatically based on your website’s content. If you have a large website with many pages, this could be a viable option.

Shopping ads: When someone searches for a product, these ads show in Google’s shopping results. If you sell financial products such as credit cards or loans, this could be a viable option.

Remarketing: This is a method that enables you to show advertisements to people who have previously visited your website. This can be an effective method of re-engaging potential clients who dropped their applications.

Example: How Bank of India Uses Google Ads

Bank of India is a financial services provider that promotes its goods and services through Google Ads.

For example, it promotes its credit cards and personal loans through search advertising.

The ads include compelling ad copy that highlights the product’s advantages.

Low-interest rates and reward schemes, for example. The landing sites are conversion-optimized, with clear application forms and call to action.

Bank of India also employs display advertisements to reach out to prospective customers who are browsing other websites.

The display ads feature eye-catching visuals and compelling ad text that entices viewers to visit the landing page.

______

Without Landing Pages, your Ads are of No use

Without Landing Pages, your Ads are of No useHere is Step by Step Guide How on How To Create A Landing Page That Converts?

Strategies for creating effective Google Ads campaigns:

Google Ads can help financial services businesses reach their target audience and increase conversions. Here are some tips for building successful Google Ads campaigns:

Understanding the audience and their needs: Companies in the financial services industry have to understand their target audience and their needs.

Credit card companies, for example, may target young adults who are just beginning to establish their credit history. Understanding your target audience will allow you to create more targeted ad copy and landing pages that will connect with them.

Creating targeted ad copy and landing pages: Ad copy and landing pages should be personalized to the target audience and the promoted product or service.

For Exp : A personal loan advertisement, for example, could highlight the ease of application and the cheap interest rates. The landing page must highlight the product’s advantages and include a clear call to action.

Leveraging Google’s retargeting capabilities: As Mentioned Above Retargeting is a method of showing advertisements to individuals who have previously visited your website.

For example, a credit card company might show ads to people who started filling out an application but didn’t complete it.

Using ad extensions to maximize ad real estate: Ad extensions are additional pieces of information that can appear alongside your ads, such as phone numbers, addresses, and links to specific pages on your website.

Using ad extensions can help maximize the real estate of your ad and make it more compelling to potential customers.

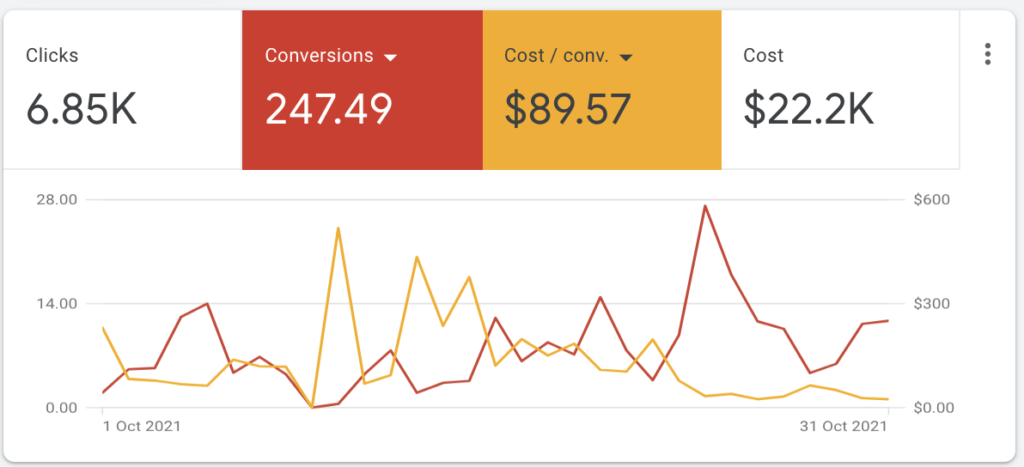

Measuring the success of your Google Ads campaign

Here are some key metrics to track:

Click-through rate (CTR): This is determined by splitting the number of views on your ad by the number of times it is displayed. A high CTR indicates that your ad is engaging and pertinent to your target audience. (CTR of 2% or higher is considered good,)

Formula = CTR = (Total Clicks on Ad / Total Impressions) x 100%

Conversion rate: This metric counts the number of individuals who clicked on your ad and then took an action, such as filling out an application or making a purchase.

Formula: Conversion rate = (Total number of conversions / Total number of clicks) x 100

Cost per conversion: The cost of acquiring each conversion, such as a completed application or a purchase, is measured here. Lowering your cost per conversion will help you increase your ROI. (ROI).

Formula: Cost per conversion = Total cost of clicks / Total number of conversions

Quality score: Google gives each ad a quality score based on variables like relevance, landing page experience, and expected click-through rate. A high-quality number can assist you in lowering your cost per click and improving ad performance.

Return on investment (ROI): This metric measures the revenue generated by your advertising campaign at the expense of running the campaign. A positive ROI means that your effort is bringing in more money than it is costing you.

Formula: ROI = (Revenue from Ads – Cost of Ads) / Cost of Ads x 100

Using Google Analytics to track and analyze these metrics can help you understand the efficacy of your ad campaign and make data-driven decisions to improve its performance over time..

For example,

let’s say a credit card company creates a Google Ads campaign to promote a new credit card with cashback rewards.

They set a goal of acquiring 100 new cardholders within the first month of the campaign.

They track their metrics using Google Analytics and find that their ad has a high CTR and conversion rate.

But their cost per conversion is higher than they would like. They make adjustments to their ad targeting and bidding strategy and see a decrease in their cost per conversion.

At the end of the month, they have acquired 120 new cardholders, exceeding their goal, and had a positive ROI. Based on this data, they make further adjustments to their campaign to continue improving its performance over time.

If you have just started your business & have NO idea how to Promote your Product & Service.Here is a Step by Step guide to Promote A New Product Or Service.

Tools can manage effective Google Ads campaigns

There are several tools available that can help you create and manage effective Google Ads campaigns for financial services. Here are some of the best tools to consider:

Google Ads Editor: This free desktop application allows you to create and edit campaigns in bulk, making it easy to make changes to your ad campaigns quickly and efficiently.

Google Analytics: This free tool allows you to track and analyze your ad campaign performance, including metrics such as traffic, conversions, and bounce rate. Use this data to make data-driven decisions to optimize your campaigns.

Google Keyword Planner: This free tool helps you research potential keywords for your ad campaigns, providing data on search volume, competition, and suggested bids.

SEMrush: This paid tool provides a range of features to help you optimize your Google Ads campaigns, including keyword research, competitor analysis, and ad copy testing.

Optmyzr: This paid tool provides a range of features to help you manage and optimize your Google Ads campaigns, including bid management, ad copy testing, and reporting.

Unbounce: This paid tool provides a range of features to help you create effective landing pages for your ad campaigns, including templates, A/B testing, and analytics.

AdEspresso: This paid tool helps you create and manage effective Google Ads campaigns, including ad creation, targeting, and optimization.

By using these tools, you can streamline your Google Ads campaign management and improve your performance over time.

It’s important to choose the tools that best meet your needs and budget and to regularly monitor and optimize your campaigns to ensure you are getting the best possible return on investment (ROI).

Overcoming Challenges and Obstacles

Financial services companies face several challenges and obstacles when it comes to creating effective Google Ads campaigns.

Here are some common challenges and how to overcome them:

Compliance and regulatory considerations for financial services ads: When it involves advertising, financial services businesses must follow strict compliance guidelines. To prevent legal issues, your advertisements must follow these guidelines.

For example, investment ads must include a disclaimer that past performance does not guarantee future results.

Navigating competition in the financial services industry: The financial services business is extremely competitive, and it can be difficult to stand out. It is essential to differentiate your product or service from the competition by writing compelling ad text and designing landing pages that highlight your unique value proposition.

Addressing common issues with ad performance and optimization:Ad success and optimization can be difficult, especially for businesses that are new to Google Ads. It is crucial to monitor and optimize your strategy regularly to increase its effectiveness over time. You can monitor conversions and other metrics with tools like Google Analytics and make changes to your campaign based on the data.

Best Practices for Financial Services Google Ads

When creating Google Ads for financial services, it is important to follow certain best practices to ensure that your ads are effective and compliant with industry regulations. Here are some best practices to keep in mind:

Ad compliance guidelines: When it comes to advertising, financial services providers must follow strict compliance guidelines. To prevent legal issues, your advertisements must follow these guidelines.

For example, credit card ads must disclose the APR, fees, and other terms and conditions clearly and conspicuously.

Ad disclaimers and disclosures: To ensure that consumers are completely informed about the product or service being promoted, financial services advertisements must include disclaimers and disclosures.

For example, investment ads must include a disclaimer that past performance does not guarantee future results.

Measuring and optimizing ad performance: It is critical to evaluate and optimize the performance of your Google Ads campaign regularly. Conversions, click-through rates, and other data can be tracked using tools such as Google Analytics. This will allow you to make changes to your strategy to increase its effectiveness.

Adjusting bids and budgets: You should regularly adjust your bids and budgets to maximize the return on investment (ROI) of your Google Ads campaign.

For example, you may increase your bid for a keyword that is driving a lot of conversions, or decrease your bid for a keyword that is not performing well.

Fintech is Hot Topic in 2023. And Indian Social Media is Buzzing with lot of Finance creators. Here is a Guide on how Influencer Marketing can boost your business.

Conclusion

Google Ads is an effective advertising platform that financial services providers can use to reach their target population and increase conversions.

You can create an effective Google Ads strategy for your business by following the steps in this blog post.

Remember to follow best practices for ad compliance and to evaluate and optimize the performance of your campaign regularly.

You can improve the efficacy of your ads by utilizing advanced Google Ads features such as dynamic search ads and remarketing.