A Practical Guide for Business Owners and Marketing Professionals

Meta platforms like Facebook and Instagram have become essential tools for financial brands. But with rising ad costs and tighter privacy rules, audience targeting for financial services is more important than ever.

Whether you’re promoting a banking product, an insurance policy, or a fintech app, this guide will help you get the most from your Meta Ads using strategies that are simple, current, and results-driven.

📌 This blog is only about Meta Ads strategies for financial services. For Google Ads or email marketing, check our other guides.

1️. Understand the Rules First: Why Facebook Has Special Rules for Finance

Finance is a sensitive topic. That’s why Meta has strict ad policies when it comes to money-related products. If you’re running ads for loans, insurance, or investments, your content needs to be clear and trustworthy.

What you should avoid:

- Promising “guaranteed returns” or “fast approval”

- Misleading offers or unclear terms

- Incomplete landing pages

👉 Keep your message honest and helpful. Add disclaimers where needed.

2️. Match the Message to the Product: What Are You Really Selling?

You can’t run good ads without first knowing who your offer is for. Every financial product has a different user group.

Examples:

- Loans & credit cards → Salaried professionals, business owners

- Health or life insurance → Age 30+, family planners, working couples

- Investment apps → First-time investors, stock traders, mutual fund buyers

- Fintech wallets → College students, mobile-first users, Gen Z

Segment your offer. Don’t treat everyone the same.

📌 We build custom funnels for each product so your ads speak to the right audience.

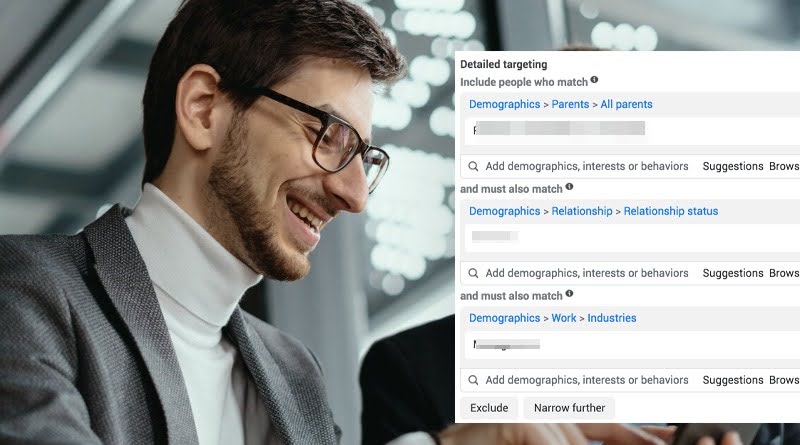

3️. Use Smart Demographic Targeting: Age, Job Title, Income, Location

As of 2025, Meta Ads still allow strong demographic filters. This is a big advantage for finance brands.

Target people by:

- Age: 25–45 for loans/investments; 45+ for retirement plans

- Job titles: CA, CFO, consultant, business owner

- Education: MBA, Finance graduate

- Location: Tier 1 & 2 cities, NRI hubs, high-income neighborhoods

Filter carefully. A high-income job title with relevant education works best.

📌 We help brands use precise targeting to lower cost-per-lead and improve conversions.

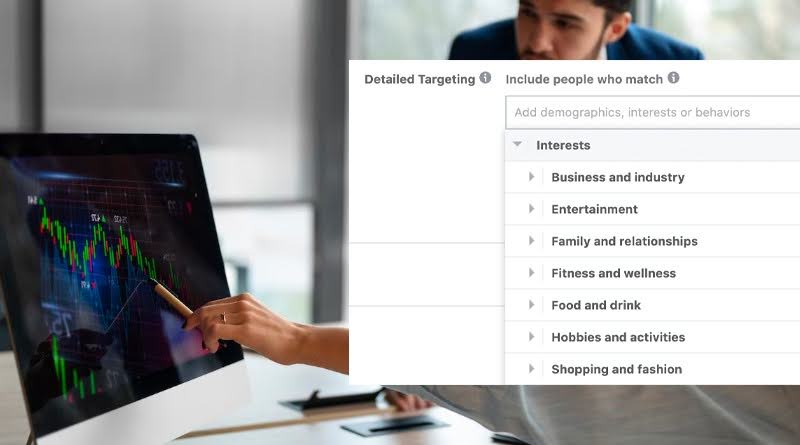

4️. Focus on Interests That Match Buyer Intent

Meta lets you target people based on what they like and follow. For financial services, this is a goldmine.

Top interests to target in 2025:

- Personal Finance & Budgeting

- Stock Market, Trading & Investing

- Crypto, Blockchain (for fintech apps)

- Business & Economic News

- Competitor Pages: HDFC, SBI, Zerodha, Paytm, Groww, PolicyBazaar

Layer your interests. Combine “Mutual Funds” + “Business News” + “Financial Planning” for best results.

📌 We create layered interest groups that reduce wasted spend and increase ad quality.

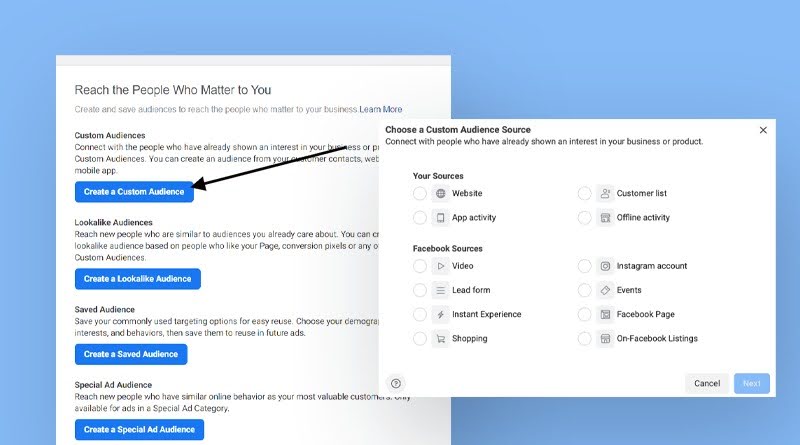

5️. Use Custom Audiences to Retarget Engaged Users

Don’t only focus on new users. Use Facebook’s Custom Audiences to retarget people who already interacted with your brand.

You can build audiences from:

- Website visitors

- CRM leads or email lists

- App users who didn’t complete signup

- People who engaged with your social media

Retarget quickly within 7 days works best.

📌 We help financial brands recover dropped leads using well-timed remarketing ads.

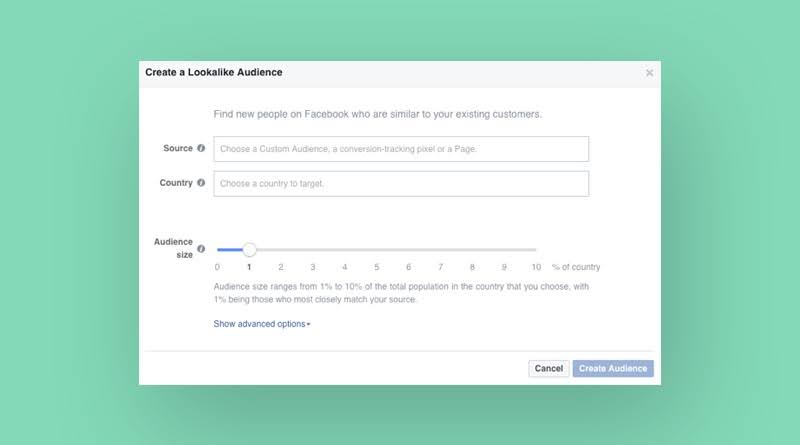

6️. Use Lookalike Audiences to Find New Prospectsts

If you already have some customer data, Facebook can help you find more people like them. This is called Lookalike Audiences.

Best sources to use:

- Your most profitable customers

- Active users of your fintech app

- Top 20% of your email leads

- Recent website converters

Use a 1% lookalike to start. It’s closest to your existing customers.

📌 We build multiple lookalike layers 1%, 2%, 5% to help you scale without losing quality.

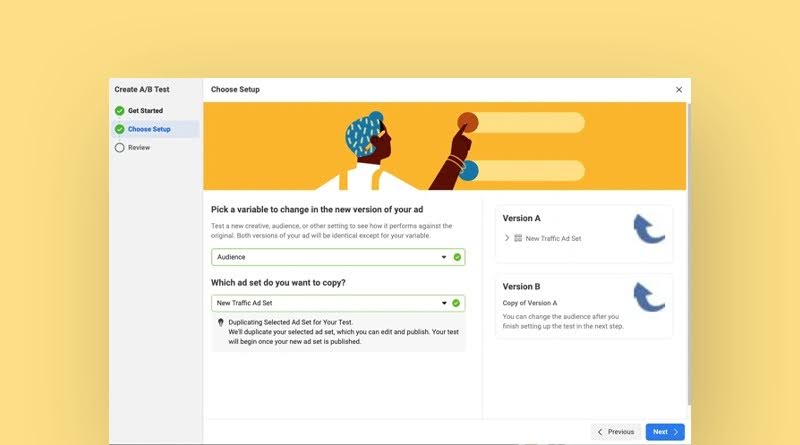

7️. Test, Don’t Guess: Why A/B Testing Still Matters in 2025

No two audiences behave the same way. That’s why testing is not optional — it’s part of your Meta Ads strategy for financial services.

Test the following:

- Interest-based vs. job title targeting

- Men vs. women

- Different income levels

- Desktop vs. mobile users

- Different languages or regions

Keep your tests clean. One change per test gives better data.

📌Our team manages weekly A/B testing and sends performance reports so you can decide what to scale.

8. Think Local: Use Languages and Regions to Go Deeper

Regional targeting works especially well in financial services, especially in India.

In 2025, we see high conversion rates from:

- Hindi, Tamil, Marathi, Bengali language ads

- Regional cities with local banks or NBFC branches

- Festival-based creatives (like Diwali loan offers, Budget season SIPs)

Speak their language literally. It builds instant trust.

📌We create regional campaigns in multiple languages for better local connect.

9. Build Trust with Clear Copy and Real Proof

In finance, people don’t just scroll — they check and verify. So your ads must build trust before asking for action.

Use:

- Real user testimonials

- Simple explanations of benefits

- Clear registration numbers (SEBI, IRDAI, RBI)

- Visuals of experts, advisors, or founders

Avoid shouting. Speak like a guide, not a seller.

📌We write ad copy that earns attention and trust not just clicks.

Track the Right Numbers: Don’t Just Look at Likes

Here’s what matters most in financial ads:

- CPL (Cost per Lead)

- CPQL (Cost per Qualified Lead)

- CAC (Customer Acquisition Cost)

- ROAS (Return on Ad Spend)

- LTV (Customer Lifetime Value)

Your ad’s success should match your business goals not vanity metrics.

📌We create performance dashboards and run weekly reports to keep your campaigns ROI-focused.

Final Thoughts: Right Audience = Right Results

Your Meta Ads won’t work unless they’re shown to the right people. In the finance world, that means smart audience targeting for financial services, local relevance, and building trust through every ad.

If you’re getting leads but no conversions, chances are you’re not targeting the right audience.