In the fast-growing world of fintech, digital payment solutions, lending products, and investment services are transforming how people manage money. For marketing professionals and business owners, Meta Ads offer powerful tools to reach the right customers efficiently. This blog will share 7 proven Meta Ad strategies tailored for payment apps, loans, and investment platforms, helping you boost user acquisition and growth.

We’ll also explain how our digital marketing services can help you get the best results from your ad campaigns.

1. Understand Your Target Audience Deeply Using Meta Ads Data

Recent research shows that fintech users differ widely by age, income, and financial needs. For example, younger users prefer mobile wallets and fast loans, while older investors look for safe, long-term wealth building.

Use Meta’s audience insights to segment your campaigns for:

- Payment app users: Target people who engage with mobile payment tools and e-commerce.

- Loan seekers: Focus on users interested in personal finance, credit scores, and borrowing.

- Investment platform users: Target those with interests in stock markets, mutual funds, or retirement plans.

With clear audience segmentation, you reduce wasted ad spend and increase leads. Our digital marketing services specialize in building precise audience profiles that match your fintech offering.

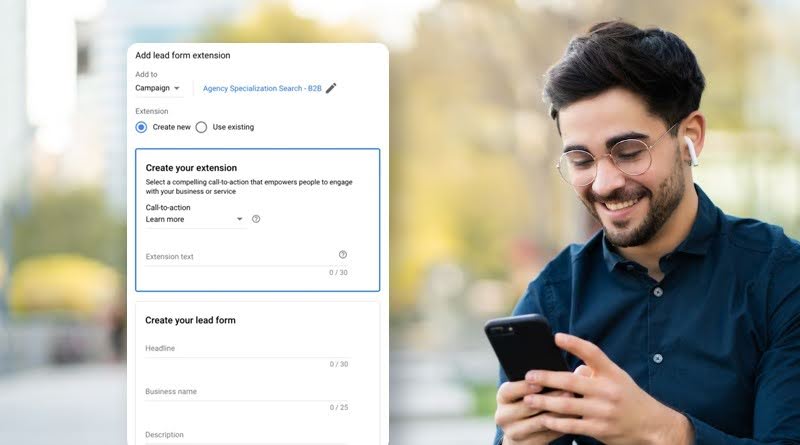

2. Use Lead Form Ads for Easy Customer Sign-ups

Meta’s Lead Form Ads allow users to sign up without leaving the platform, reducing friction.

Why this works for fintech:

- Customers feel more secure as they don’t have to visit unknown external sites.

- Forms can be pre-filled with Facebook data, speeding up completion.

- Collect only essential information to respect privacy and avoid drop-offs.

For example, a loan app running a campaign with lead forms saw a 40% increase in applications compared to regular ads.

Our team creates and tests optimized lead forms designed to maximize sign-ups while keeping user trust high.

3. Use Retargeting Ads to Convert Interested Users

Most users don’t convert on the first visit. Retargeting ads help you stay top of mind for people who:

- Visited your app download page but didn’t install

- Started a loan application but didn’t complete it

- Viewed investment product pages without signing up

A study from 2024 showed retargeting campaigns generate 3 times higher conversions for fintech brands.

We build custom retargeting audiences and design creative ads reminding users of benefits and limited offers, improving your ROI.

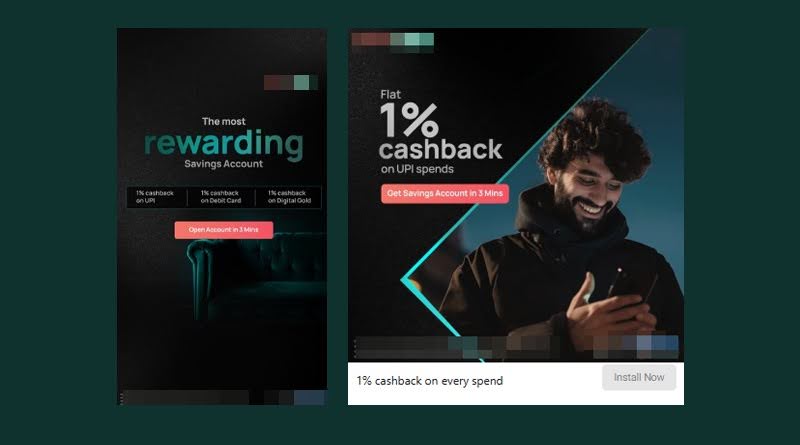

4. Create Video Ads to Explain Complex Financial Products Simply

Investment platforms and loan services often face challenges explaining features clearly.

Short, engaging video ads can:

- Explain how your product works in simple language

- Show real customer success stories

- Build trust with transparent information

Meta reports that video ads see 5 times more engagement in financial services than static images.

We develop video scripts and designs that speak directly to your audience, simplifying complex messages for better understanding.

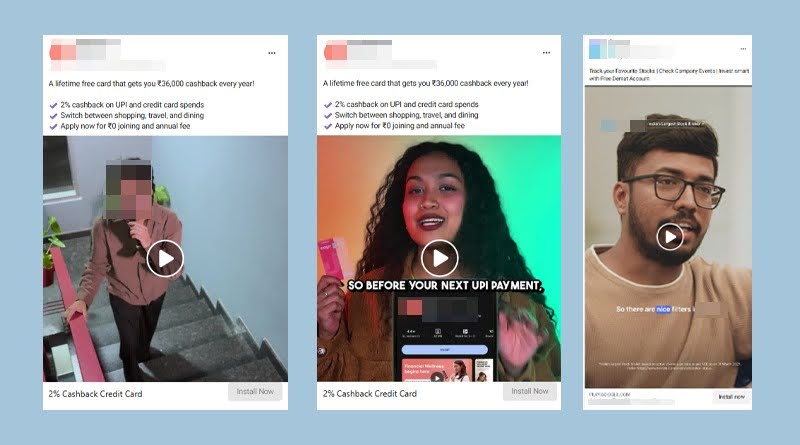

5. Optimize Your Ads with A/B Testing for Best Results

There is no one-size-fits-all in fintech advertising. You need to test:

- Different headlines and ad copies

- Various images or videos

- Multiple call-to-actions (CTAs)

- Target audience segments

Recent data suggests A/B testing can improve ad performance by up to 50%. Our digital marketing experts run continuous tests, using real-time data to refine your campaigns and lower your cost per lead.

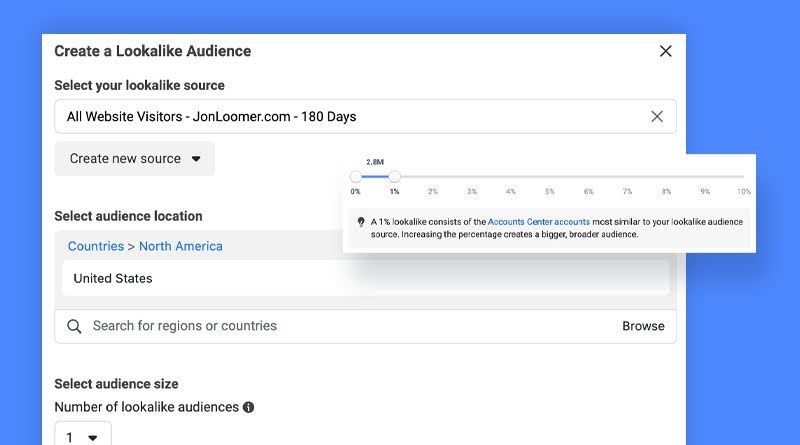

6. Use Lookalike Audiences to Find New High-Quality Customers

Meta’s lookalike audiences help you reach new users similar to your best customers.

For example, if your top loan customers are young professionals with good credit, a lookalike audience will find similar profiles, increasing chances of conversion.

Lookalike campaigns have delivered 30-40% better acquisition costs for fintech clients in the past year.

Our team manages these audiences carefully to maintain quality and scale growth.

7. Always Include Clear Compliance and Trust Signals in Ads

Financial products require trust. Ads must clearly show:

- Compliance with financial regulations

- Security of user data

- Transparent fees and terms

Adding trust badges, customer reviews, or regulatory licenses to your ads increases confidence and reduces drop-offs.

We help you design compliant ads that build trust without overwhelming the message.

Why Partner With Us for Your Meta Ads Campaigns?

Running Meta Ads for payment apps, loans, and investment platforms is complex. You need experts who understand fintech’s unique challenges and opportunities.

Our digital marketing services cover everything:

- Audience research and segmentation

- Creative development and testing

- Lead form optimization

- Retargeting and lookalike audience management

- Compliance-focused ad design

- Continuous campaign analysis and improvement

This hands-on approach has helped many fintech brands lower their customer acquisition cost and grow steadily.

Conclusion

Meta Ads provide powerful tools to promote payment apps, loans, and investment platforms in today’s digital world. By using clear audience targeting, lead form ads, retargeting, video content, A/B testing, lookalike audiences, and trust signals, you can boost conversions and build loyal customers.

If you want expert help in crafting and running these campaigns, our digital marketing services are ready to support your fintech business growth.