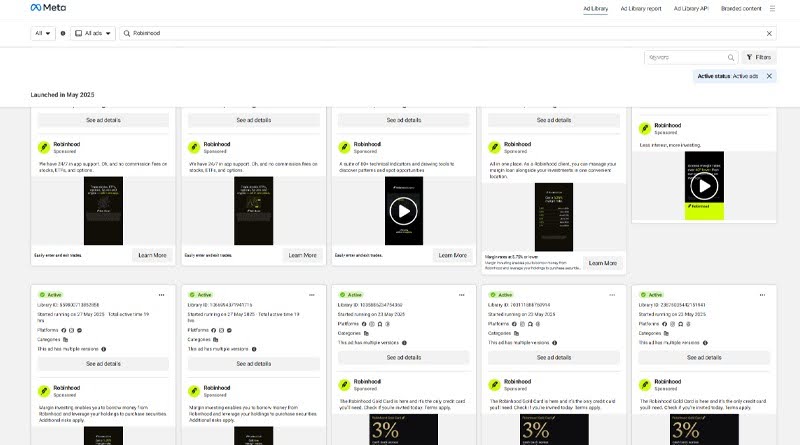

1. Why Facebook Ads Are the Best Choice for FinTech in 2025

Digital marketing has changed a lot over the years, but Facebook and Instagram ads still lead for FinTech companies. Recent research shows that nearly 70% of FinTech marketers say Meta Ads provide the best return on investment compared to Google Ads or other channels. Why? There are three main reasons:

- Precise Audience Targeting: Facebook lets you target people by age, location, interests, and even behaviors like financial habits or app usage. For FinTech, this means you can reach exactly those who are likely to need your services.

- Multiple Ad Formats: You can use videos, images, slideshows, and carousel ads to explain your product. Financial products can be complicated. The right ad format helps simplify things.

- Social Proof and Engagement: People trust recommendations from others. Facebook allows users to like, comment, and share your ads, which helps build credibility and trust.

With more than 2.9 billion monthly users on Meta platforms in 2025, the reach is huge. Facebook Ads help your FinTech brand reach a large and relevant audience, build trust, and drive real business results.

2. How Storytelling Builds Trust and Connects Emotionally

Financial products and services can seem complex and impersonal. But people make financial decisions based on emotions as much as logic. According to a study by Stanford University, stories are 22 times more memorable than facts alone. Why is storytelling so effective for FinTech Facebook ads?

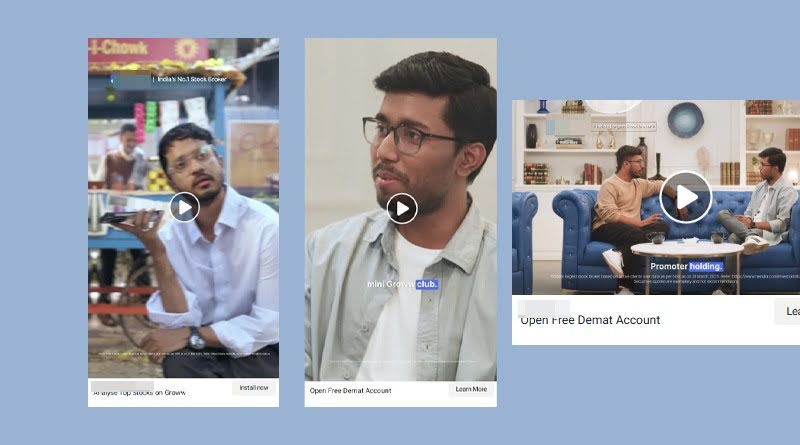

- Humanizes Your Brand: Instead of just showing features, you share a relatable story. This makes your company feel more like a trusted partner.

- Simplifies Complex Ideas: Financial products can be confusing. A story breaks down the problem, the solution, and the outcome in a way people understand.

- Triggers Emotions: People may fear losing money or want financial security. A story can connect with these emotions and motivate action.

For example, instead of just saying, “Our app improves loan approvals by 30%,” you tell a story about a small business owner who used your app to get funding quickly and grow her business. This story makes the benefit clear and relatable.

3. 3 Simple Steps to Craft Powerful Stories for Your Facebook Ads

Creating good stories for your Facebook Ads doesn’t have to be complicated. Here are three practical steps:

Step 1: Focus on One Main Problem Your Product Solves

Pick one key issue your FinTech product addresses. Maybe it’s long loan processing times, difficulty managing expenses, or lack of transparency. Focusing your story on one problem helps keep it clear and relatable.

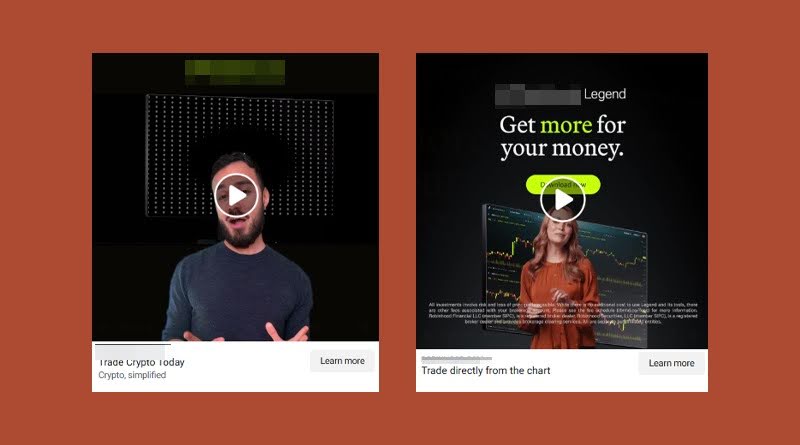

Step 2: Use Visual Formats That Work on Facebook

Videos and image carousels perform best on Facebook because they catch attention and tell a story visually. A 30-second video showing a customer’s journey or a carousel that highlights the problem, solution, and result step-by-step works well.

Step 3: End With a Clear Call-To-Action (CTA)

After telling your story, tell people exactly what to do next. Use simple CTAs like “Learn More,” “Sign Up Today,” or “Download the App.” Don’t leave them guessing.

4. Why Case Studies Are a Must-Have in Your 2025 Ad Strategy

In 2025, consumers are more careful with their money. According to a survey by Demand Gen Report, 85% of people read case studies before choosing a financial product or service. Case studies prove that your product works and help reduce skepticism.

A good case study ad shows:

- Real Customer Challenges: What problem did the customer face?

- Your Solution: How did your product or service help?

- Measurable Results: Use numbers wherever possible, like “Reduced loan approval time by 40%” or “Saved $10,000 annually.”

Case studies add credibility and show proof. They make people feel confident to try your product.

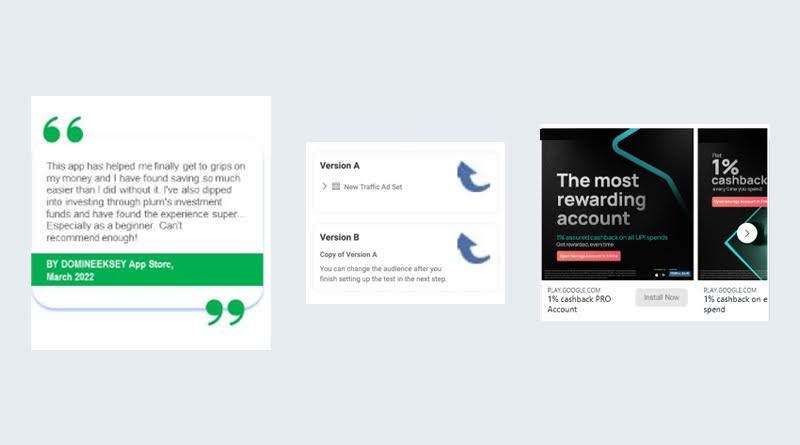

5. 4 Tips to Make Case Study Ads Work on Facebook

Not all case study ads perform well. Here are four tips to make yours effective:

Tip 1: Use Real Data and Protect Privacy

Always get permission from customers before sharing their story. Mask any private info and keep the focus on results.

Tip 2: Keep It Short and Clear

People scroll quickly on Facebook. Use bullet points or a short video that highlights the key facts. Avoid long paragraphs.

Tip 3: Use Visuals to Highlight Key Results

Charts, graphs, or numbers in bold help draw attention to your results. For example, a simple bar chart showing “Loan approvals before and after” grabs eyes.

Tip 4: Target the Right Audience

Match the case study to the audience segment. If the case study is about small business loans, target ads to business owners, not general consumers.

6. How to Combine Storytelling and Case Studies for Best Results

One of the most effective strategies is to combine storytelling and case studies in your Facebook Ads. Here’s how:

- Use Customer Testimonial Videos: Let customers tell their own stories in their own words. This is highly authentic.

- Create Carousel Ads: Break the story into parts — the challenge, how your product helped, and the success — so people can swipe through.

- Run A/B Tests: Test emotional stories against data-driven case studies to see which performs better with your audience.

- Use Retargeting Ads: Show more detailed case studies to people who have interacted with your initial ads but didn’t convert.

Tracking key metrics like click-through rates (CTR), cost per lead (CPL), and conversion rates will help you fine-tune this approach.

7. 3 Common Mistakes to Avoid in FinTech Facebook Ads

Avoid these mistakes to improve your Facebook Ads performance:

Mistake 1: Using Too Much Financial Jargon

Your ads should be easy to understand. Avoid technical terms or complex language. Remember, your audience may not be finance experts.

Mistake 2: Missing a Clear Call-To-Action

If your ad doesn’t tell people what to do next, you lose potential customers. Always include a simple, clear CTA.

Mistake 3: Using the Same Message for Everyone

Your audience has different needs. Segment them and create ads that speak directly to each group. Don’t use a one-size-fits-all approach.

8. How Our Digital Marketing Services Can Boost Your FinTech Growth

Creating effective Facebook Ads for FinTech is our specialty. Here’s how we help FinTech companies like yours grow:

- Custom Storytelling and Case Study Ads: We develop ads that tell stories your audience relates to and show real proof with case studies.

- Precise Audience Targeting: We use Facebook’s advanced targeting to reach the people who will benefit most from your product.

- Regulatory Compliance: We ensure your ads follow all financial advertising rules and respect customer privacy.

- Continuous Testing and Optimization: We monitor your campaigns daily and optimize to get the best return on your ad spend.

Partnering with us means you get expert help to build trust, attract more customers, and grow your FinTech business.

9. Final Thoughts: Start Using Stories & Case Studies in Your Facebook Ads Today

In 2025, using storytelling and case studies in Facebook Ads is one of the smartest ways to grow your FinTech business. Stories make your brand human and relatable. Case studies provide the proof your potential customers need to trust you.

Don’t wait. Start adding real stories and clear proof to your ads. And if you want expert help to create high-performing Meta Ads for your FinTech brand, contact us for a free consultation.