In today’s competitive financial market, promoting loan offers and financial advisory services requires more than traditional marketing.

Platforms like Meta Ads (Facebook and Instagram) have become essential for reaching potential borrowers and investors in a targeted, cost-effective way.

If you are a marketing professional or a business owner in the financial sector looking for practical, updated strategies, this guide is for you.

We will also show how professional digital marketing support, like what we offer at Insightus Digital, can help you achieve better results faster.

1. Why Meta Ads Are Ideal for Promoting Financial Services

Meta Ads offer powerful advantages for financial companies:

- Advanced audience targeting by demographics, behaviors, interests.

- Cost-efficient lead generation with budget control.

- Customizable messaging for different loan products or financial services.

- High-volume reach while maintaining personalization.

According to Statista 2024, over 2.9 billion people use Meta platforms monthly, making it one of the best places to find new clients for financial products.

For businesses serious about growing, Meta Ads are no longer optional — they’re essential.

✅ Need expert handling of your financial ad campaigns? Explore our financial services marketing solutions.

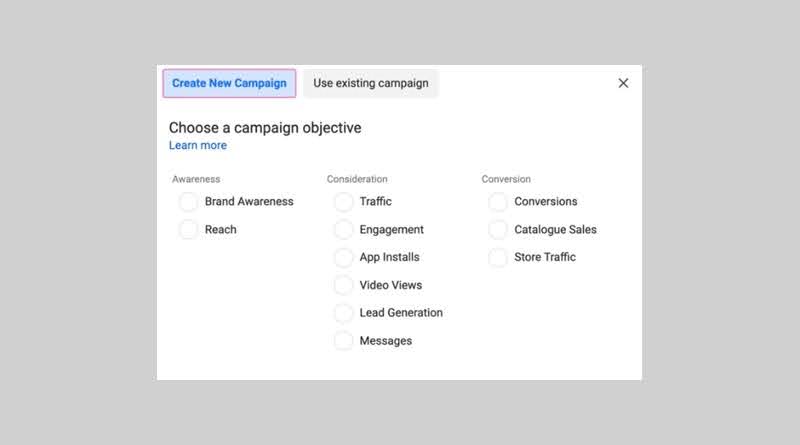

2. Setting Clear Goals for Your Loan & Advisory Campaigns

Before you start spending, define what you want to achieve. Common goals for financial services marketing through Meta Ads include:

- Generate loan applications.

- Book appointments with financial advisors.

- Build awareness of new financial products.

- Educate audiences about financial planning.

Clear goals ensure you build ads that truly work, not just collect impressions.

At Insightus Digital, we help businesses set the right campaign objectives aligned with their financial business needs.

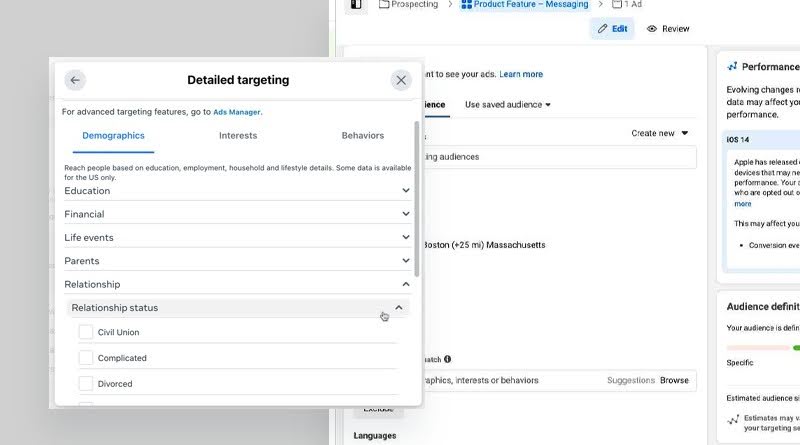

3. Researching Your Audience: The First Step to Profitable Ads

Effective audience targeting starts with research.

For promoting loan offers and financial advisory services, consider:

- Age groups eligible for different loans.

- Income brackets matching loan or investment products.

- People searching for financial solutions (like “best home loans,” “how to invest,” etc.).

- Business owners looking for working capital.

Meta’s Audience Insights tool can be very useful here.

However, professional digital marketers can dig deeper with first-party data and custom audiences — which often brings better returns.

✅ Want better targeting? Master audience targeting with us.

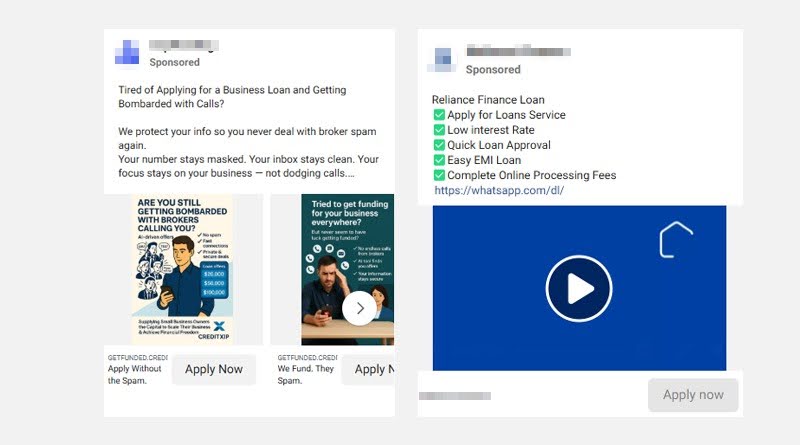

4. Crafting High-Converting Financial Ad Copy and Creatives

Financial ads need to build trust instantly.

Here’s what works best for loan offers and financial advisory services:

- Use clear headlines like “Affordable Business Loans in 48 Hours.”

- Highlight benefits, not just features (e.g., “Save more for retirement” instead of “Retirement Plan Advice”).

- Keep it simple. Avoid jargon like APR%, unless explained well.

- Add testimonials if possible — social proof matters.

For creative formats, use:

- Carousels to display multiple loan types.

- Video ads explaining financial concepts simply.

- Instant forms for quick lead generation.

Good ads can lower your lead cost by 30-50% according to Meta’s latest benchmarks (2024).

✅ Need help creating high-converting ads? Our social media marketing experts can help.

5. Choosing the Right Meta Ad Formats for Financial Services

Not all ad formats work equally well.

Here’s what financial marketers should focus on:

| Ad Format | Best Use |

| Lead Ads | Directly capture lead info within Facebook. |

| Video Ads | Explain complex financial products easily. |

| Carousel Ads | Showcase multiple loan options or services. |

| Messenger Ads | Initiate direct conversations with clients. |

Lead generation campaigns using Lead Ads often deliver the best ROI for financial sectors because they reduce friction and capture information quickly.

✅ Want to set up winning campaigns? Learn how to build high-converting lead generation campaigns.

6. Building Trust and Credibility with Your Meta Ads

Trust is everything in finance.

Some ways to increase credibility in your Meta Ads:

- Mention certifications (like SEBI registration, RBI compliance, etc.).

- Show client success stories (e.g., “Helped 500+ clients achieve financial goals”).

- Use real staff photos instead of stock images.

- Keep disclaimers visible and honest.

According to a 2024 Edelman Trust report, financial services remain among the industries where trust-building greatly affects purchase decisions.

✅ Want help with financial trust-building strategies? Get in touch with our financial digital marketing team.

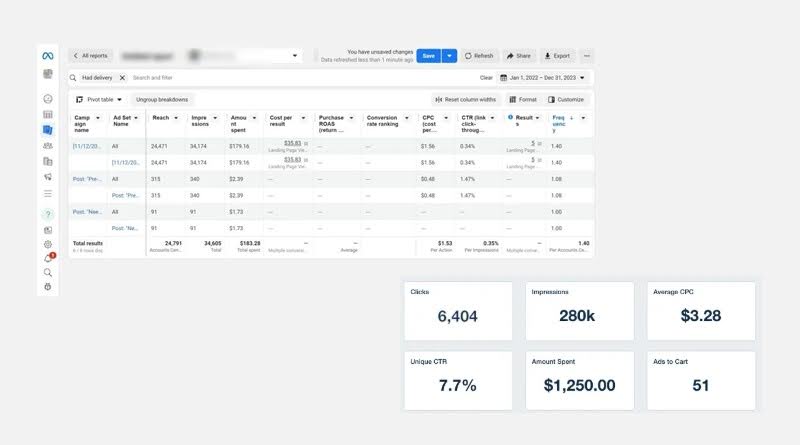

7. Tracking Key Metrics: What Matters for Financial Ads

Measuring performance is crucial.

Some key metrics to monitor include:

- Cost per lead (CPL)

- Lead quality score

- Click-through rate (CTR)

- Conversion rate on landing pages

- Return on ad spend (ROAS)

Meta’s Ad Manager allows deep tracking if you configure your Pixel correctly.

We at Insightus Digital also offer advanced tracking solutions for financial services — ensuring you know where every rupee is going.

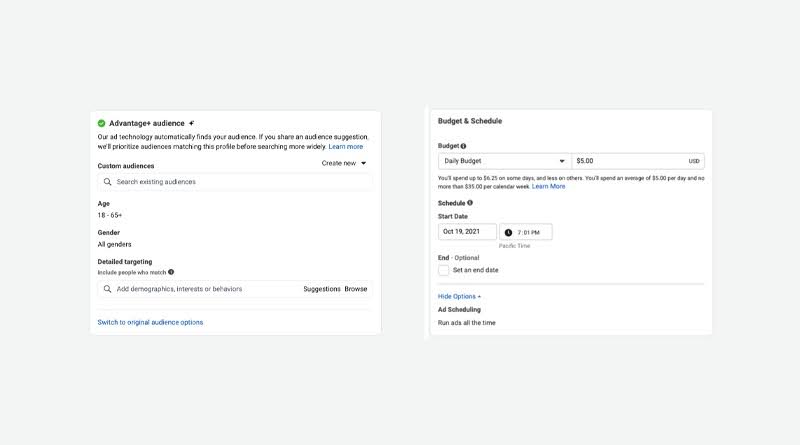

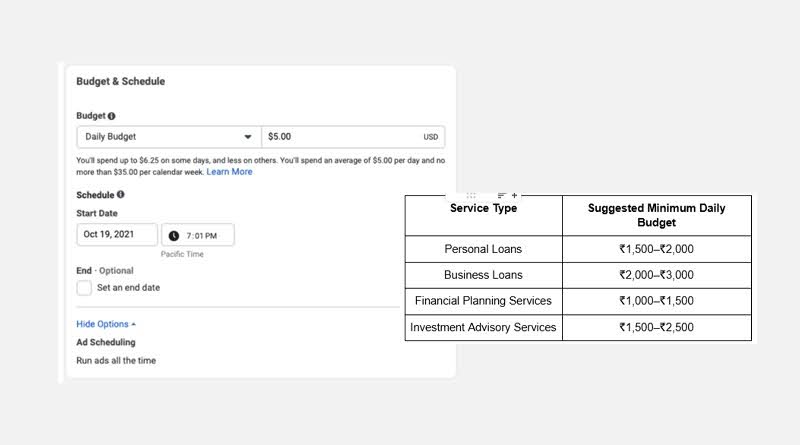

8. Budgeting Smartly: How Much Should You Spend?

For loan offers and financial advisory services, recommended daily spend varies:

| Service Type | Suggested Minimum Daily Budget |

|---|---|

| Personal Loans | ₹1,500–₹2,000 |

| Business Loans | ₹2,000–₹3,000 |

| Financial Planning Services | ₹1,000–₹1,500 |

| Investment Advisory Services | ₹1,500–₹2,500 |

Start with a modest budget, then scale based on real results, not guesses.

✅ Need a customized media plan for your financial firm? Talk to our experts at Insightus Digital.

9. Common Mistakes to Avoid in Financial Meta Advertising

Many businesses unknowingly waste money because of these mistakes:

- Running generic ads without audience segmentation.

- Using complicated language that confuses users.

- Not testing multiple creatives or ad copies.

- Not following compliance guidelines properly.

A small misstep in financial advertising can cost you thousands in lost leads and reputation.

Working with specialized financial digital marketers can help you avoid these mistakes from day one.

10. Conclusion: Unlock Growth for Your Financial Business with Meta Ads

Meta Ads are powerful tools to grow your loan and financial advisory business — but only when used properly.

It’s not about spending more — it’s about spending smarter with clear goals, right targeting, and trust-building ads.

If you are serious about scaling your loan offers or financial advisory services, now is the time to invest in professional digital marketing support.

At Insightus Digital, we specialize in financial services marketing and can help you set up high-converting, compliant, and profitable Meta campaigns.